Our investment services

Funding your foundation. Scaling your future

Strategic capital for early-stage ventures, expert advisory for established businesses

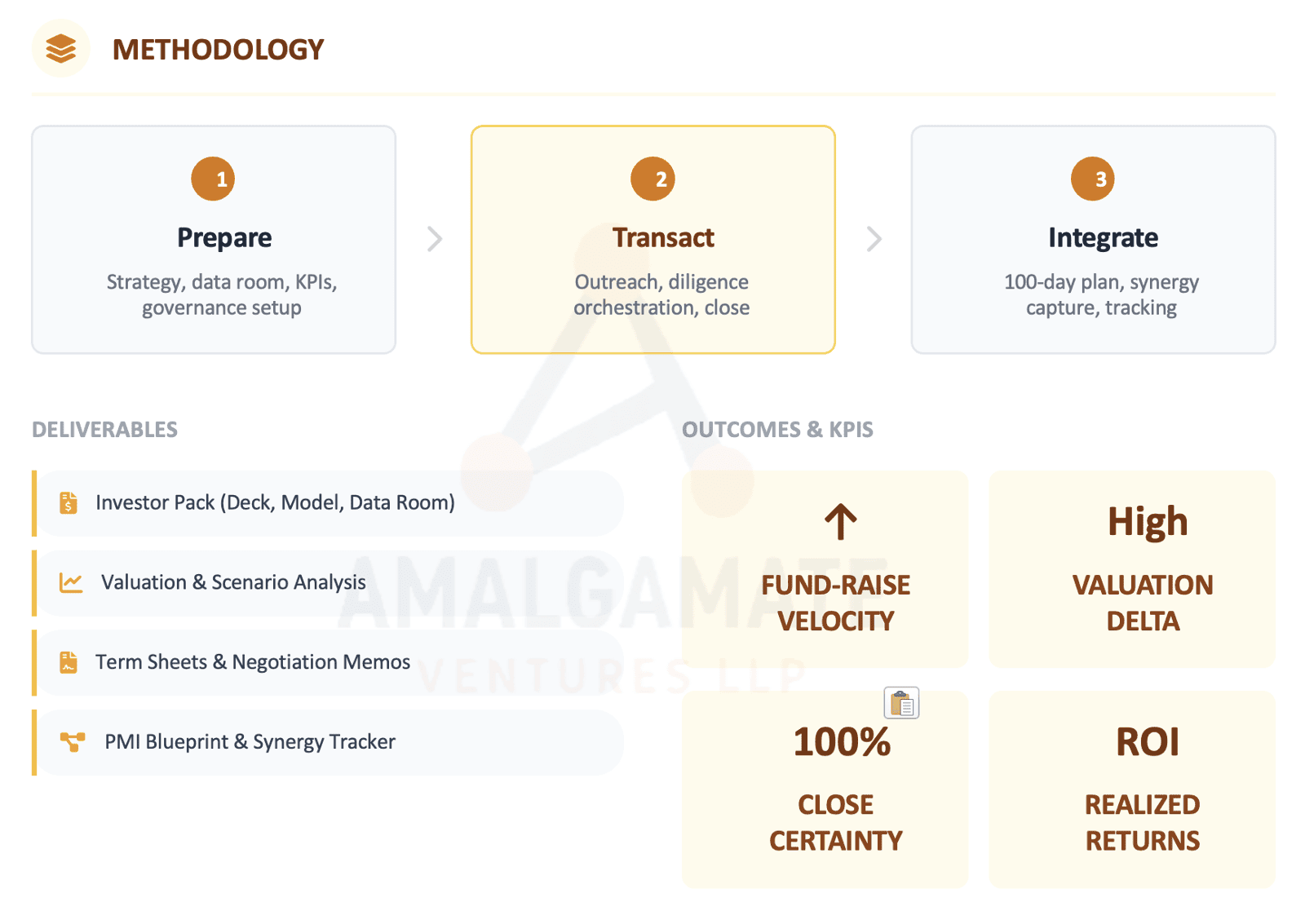

Deals & Corporate Finance

Key offerings

Capital Strategy

Fundraising readiness (Equity/Debt) and structuring

Financial Modeling

Robust valuation scenarios and investor models

Deal Structuring

Term sheet negotiation and capital table optimization

M&A Advisory

Buy-side/sell-side diligence and transaction management

Post-Deal Integration

PMI blueprints and synergy capture

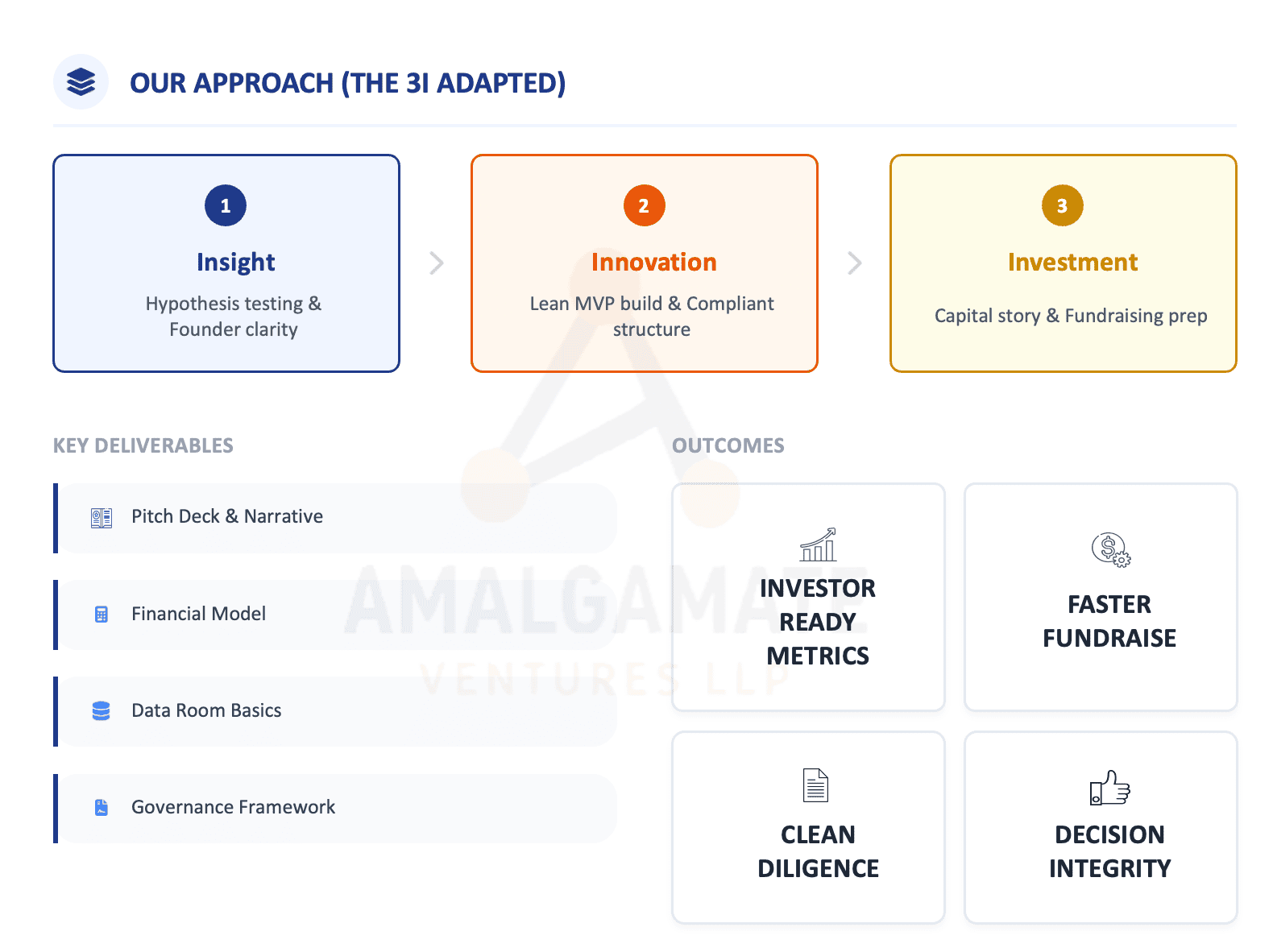

Pre-funding Readiness

From napkin sketch to fundable venture

What we solve

Ad-hoc Build

Execution without governance structure

Unclear Metrics

Lack of KPI definition and tracking

Investor Unreadiness

Narrative gaps and weak materials

Messy Cap Table

Equity issues that block funding

Compliance Risks

Regulatory exposure from day one

Early-Stage Services

From product-market fit to scalable growth

Key offerings

Idea Validation

Founder-market fit assessment and workshops

MVP Roadmap

GTM experiments, customer discovery, and sprint planning

Financial Modeling

Pre-revenue unit economics and pricing strategy

Investor Readiness

Pitch deck narrative and materials creation

Governance Setup

Articles, ESOP, and risk/compliance basics